Disclaimers

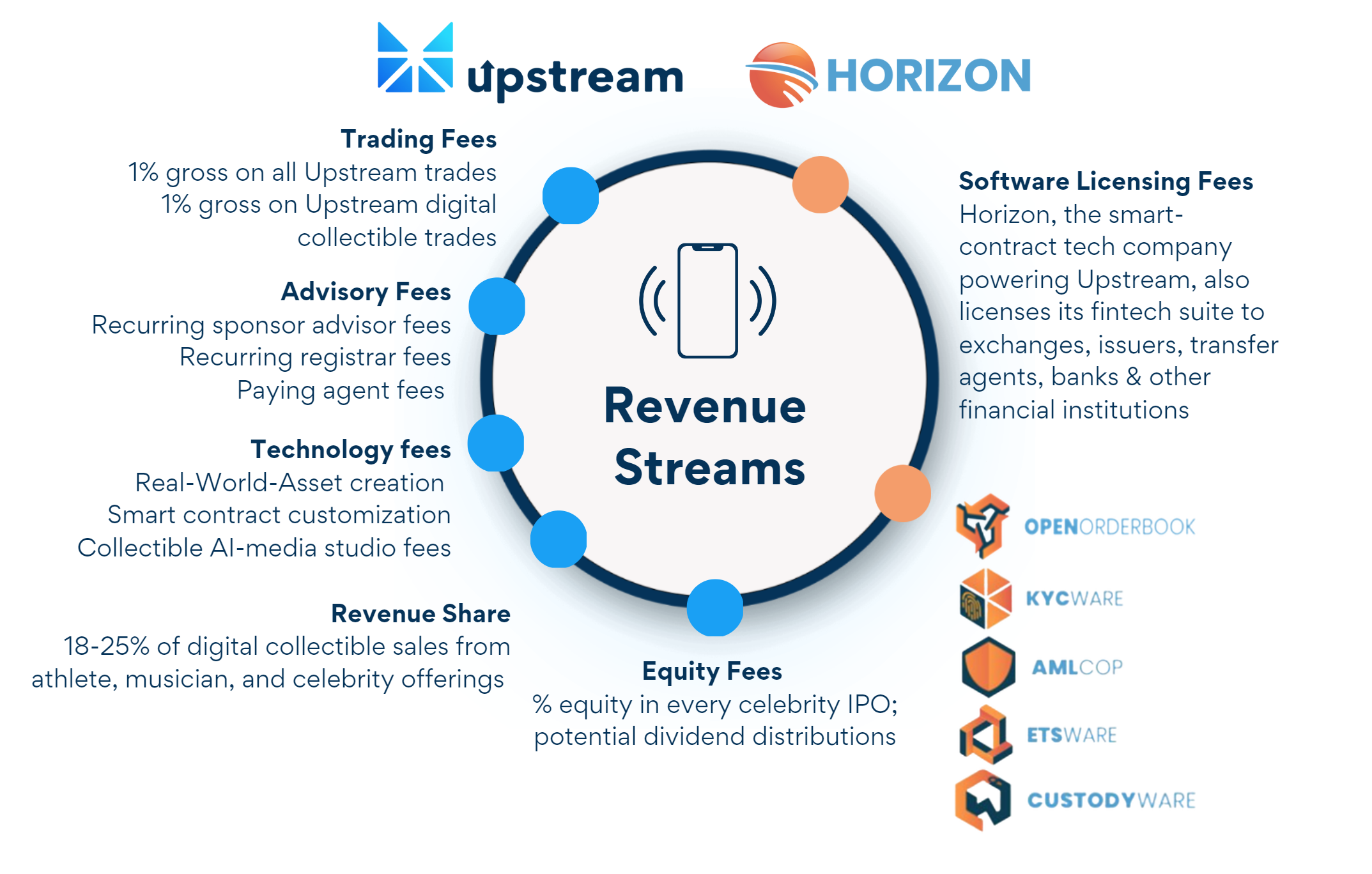

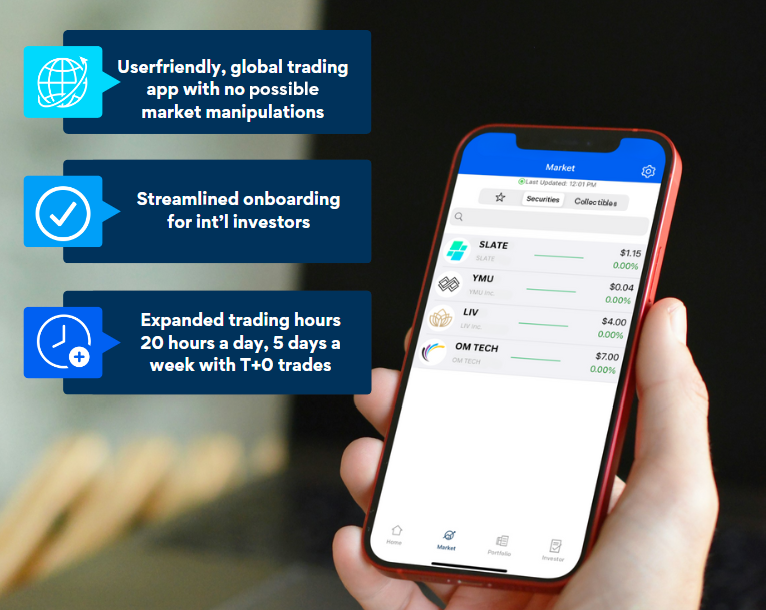

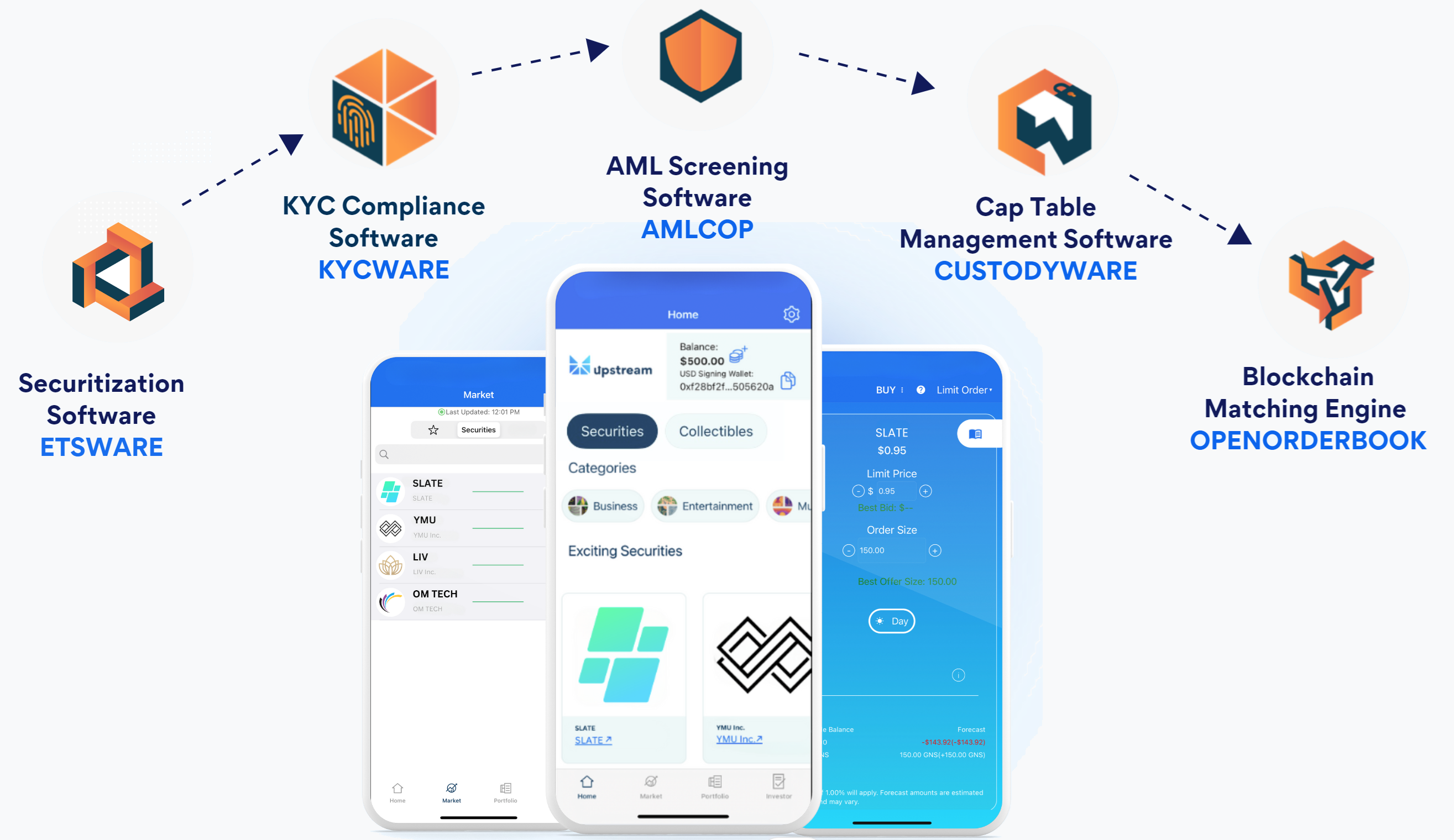

Investors are not investing in Upstream. They are investing in GlobexUS, the parent company of Horizon, which powers Upstream—the first large-scale application of our technology—operated by a 50/50 JV Partnership with MERJ Exchange (MERJ) and Horizon, a wholly owned subsidiary of GlobexUS Holdings Corp.

Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 105 Maxess Road, Suite 124, Melville, NY 11747, is the, located at 4000 Eagle Point Corporate Drive, Suite 950, Birmingham, AL 35242, is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA's BrokerCheck.

DealMaker Securities LLC does not make investment recommendations.

DealMaker Securities LLC is NOT placing or selling these securities on behalf of GlobexUS.

DealMaker Securities LLC is NOT soliciting this investment or making any recommendations by collecting, reviewing, and processing an Investor's documentation for this investment.

DealMaker Securities LLC conducts Anti-Money Laundering, Identity and Bad Actor Disqualification reviews of companies, and confirms they are a registered business in good standing.

DealMaker Securities LLC is NOT vetting or approving the information provided by GlobexUS or GlobexUS itself.

Contact information is provided for Investors to make inquiries and requests to DealMaker Securities LLC regarding Regulation CF in general, or the status of such investor’s submitted documentation, specifically. DealMaker Securities LLC may direct Investors to specific sections of the Offering Circular to locate information or answers to their inquiry but does not opine or provide guidance on issuer related matters.

This website contains forward-looking statements. These statements may include the words “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “project”, “will”, “may”, “targeting” and similar expressions as well as statements other than statements of historical facts including, without limitation, those regarding the financial position, business strategy, plans, targets and objectives of the management of GlobexUS (the "Company") for future operations (including development plans and objectives). Such forward-looking statements involve known and unknown risks, uncertainties and other important factors which may affect the Company's ability to implement and achieve the economic and monetary policies, budgetary plans, fiscal guidelines and other development benchmarks set out in such forward-looking statements and which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company's present and future policies and plans and the environment in which the Company will operate in the future. Furthermore, certain forward-looking statements are based on assumptions or future events which may not prove to be accurate, and no reliance whatsoever should be placed on any forward-looking statements in this presentation. The forward-looking statements in this website speak only as of the date of the Company's initial Form C, and the Company expressly disclaims to the fullest extent permitted by law any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

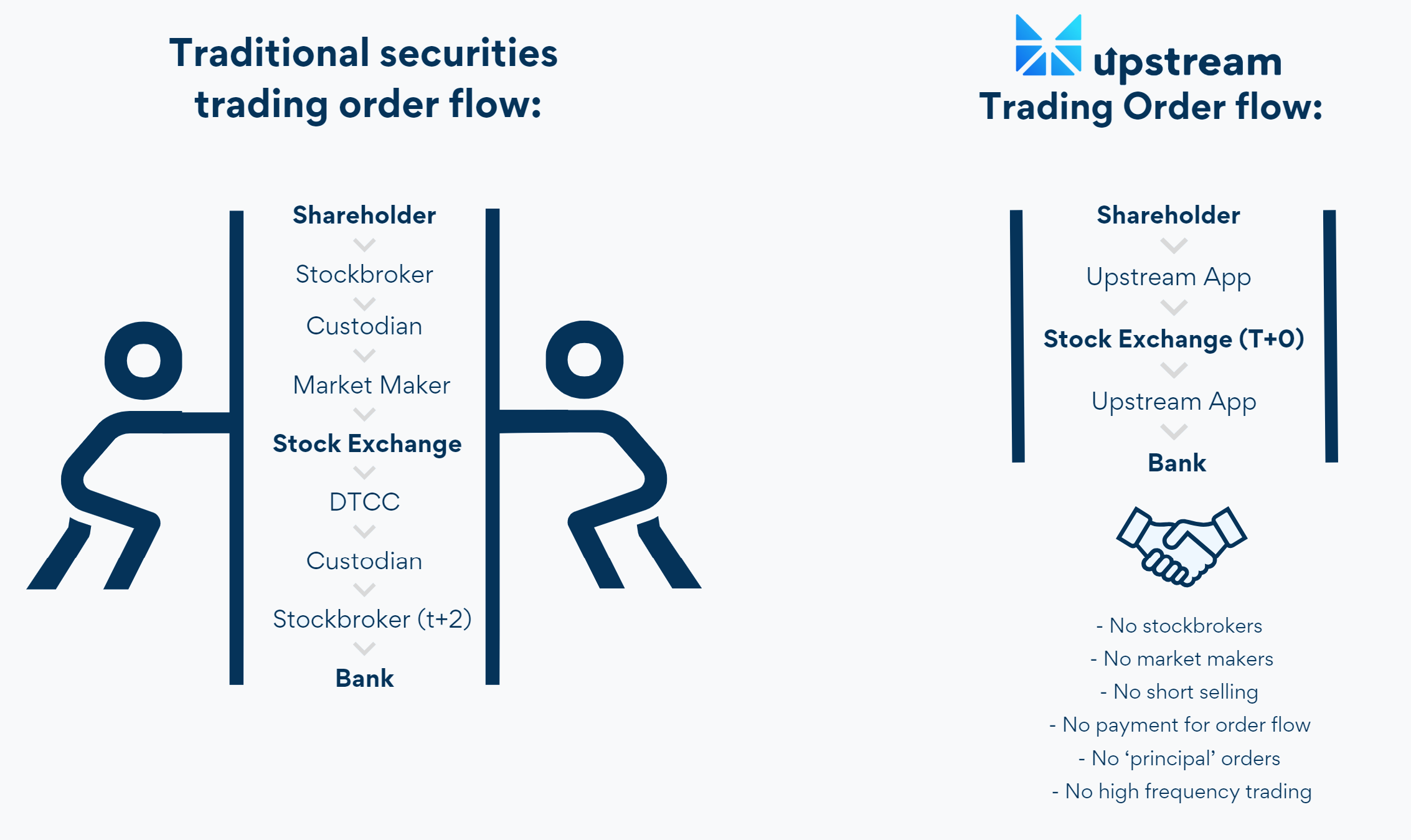

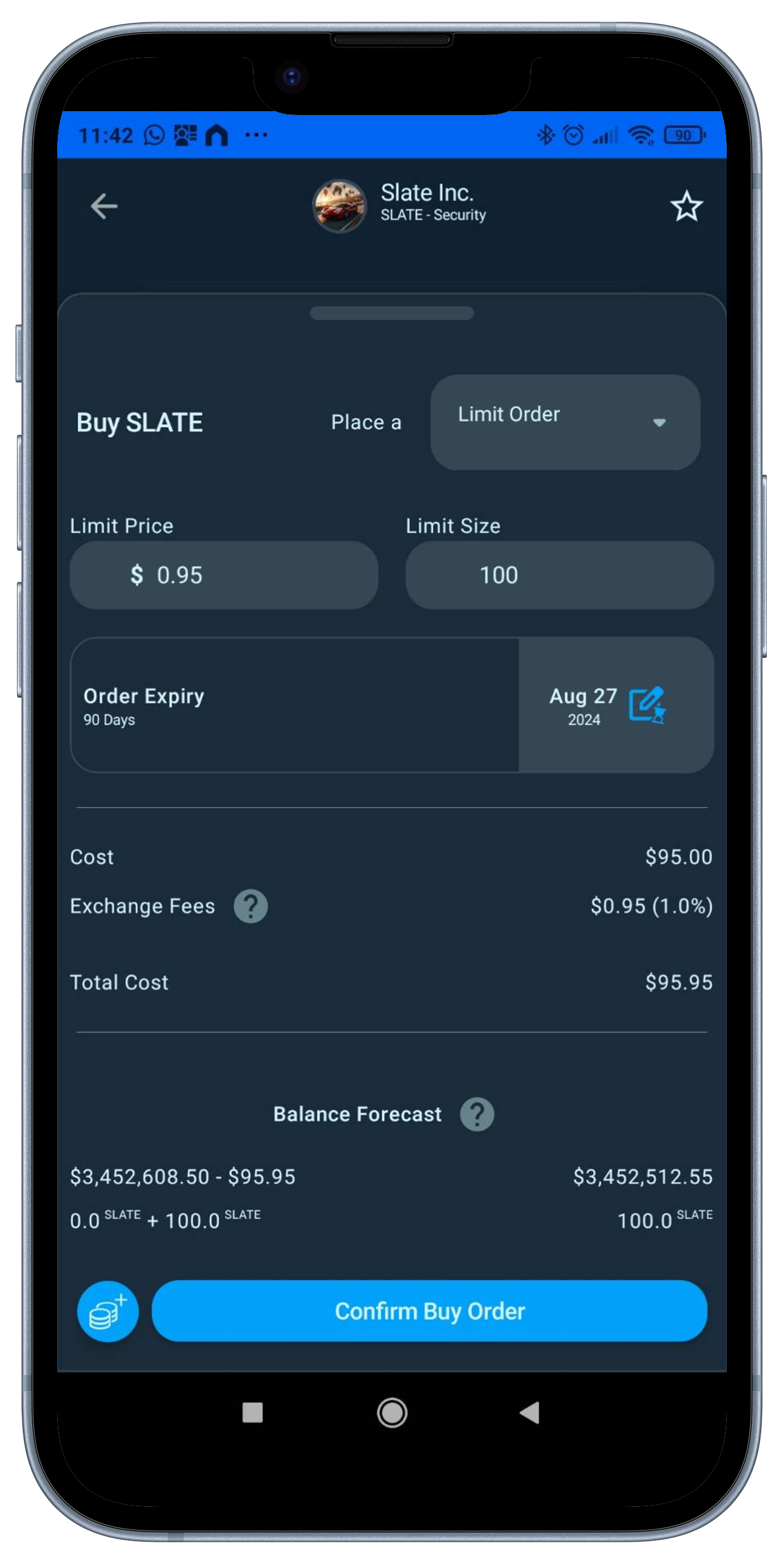

Upstream is a MERJ Exchange market. MERJ Exchange is a licensed Securities Exchange, an affiliate of the World Federation of Exchanges, a National Numbering Agency, and a member of ANNA. MERJ is regulated in the Seychelles by the Financial Services Authority, https://fsaseychelles.sc/, an associate member of the International Association of Securities Commissions (IOSCO). MERJ supports global issuers of traditional and digital securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions without aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site or app, you agree to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development-stage companies. U.S. persons may not deposit, buy, or sell securities on Upstream. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative and qualitative listing standards.

This communication shall not constitute an offer to sell securities or the solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation is not permitted. Collectibles have no royalties, equity ownership, or dividends. Collectibles are for utility, collection, redemption, or display purposes only. Anyone may buy and sell Collectibles on Upstream. All orders for sale are non-solicited by Upstream and a user’s decision to trade securities must be based on their own investment judgment.